What Real Estate Agents Do Not Tell You About Living in Omaha

Thinking about living in Omaha? There are plenty of brochures that sell the parks, the college world series, and the amazing zoo. Those are great reasons to consider a move. But the honest, practical details that shape day-to-day life do not always show up on glossy pamphlets. This guide covers the things you should know before relocating, especially if you want to avoid surprises after the boxes are unloaded.

Table of Contents

- Property Taxes in Omaha

- Radon in Omaha Homes

- Basements in Omaha: Storm Shelter vs. Water Risk

- Lead, Superfund Sites, and Important Disclosure Steps for Omaha Buyers

- Neighborhoods in Omaha

- Omaha Weather and Microclimates

- Homeowners Insurance in Omaha

- Car Registration, Taxes, and Transportation Realities in Omaha

- Omaha Roads, Construction, and the City’s Growth Spurt

- Culture and Community: Why Living in Omaha Feels Different

- Practical Checklist for Anyone Moving to Omaha

- FAQs About Living in Omaha

Property Taxes in Omaha

One of the biggest surprises for people moving here is how property taxes are paid. If you are living in Omaha, you should know property taxes are paid in arrears. That means the tax bill you pay in a given year is for the previous year. For example, taxes assessed for 2025 are due in 2026.

That timing affects buyers and sellers at closing. When a purchase happens mid-year, the purchase agreement typically treats the last calendar year’s taxes as the current taxes for proration. The practical result: if you close on a home in June, you will likely see a prorated portion of the prior year’s tax bill on your closing statement. The title company divides the amount between buyer and seller based on the closing date.

Some useful points to remember:

- Assessed value is not market value. The county assessor sets an assessed value for tax purposes; the market determines sale price.

- Prorations are normal. Title companies will calculate how much of the last tax bill you owe based on the closing date.

- New construction may get a one-year break. In some cases the first tax year you may only pay taxes on the lot, not the improvements. Expect taxes to rise on the reassessment the following year.

- There is protest process. If you think the assessor’s valuation is too high, you can protest the valuation with the county.

- Exemptions exist. Veterans with 100 percent service connected disability and qualified seniors on fixed incomes may qualify for tax exemptions.

These mechanics are why anyone relocating and living in Omaha should budget for property taxes carefully. The number on your closing statement may not reflect the full annual burden; it simply accounts for the previous assessment year and the proration between buyer and seller.

Radon in Omaha Homes

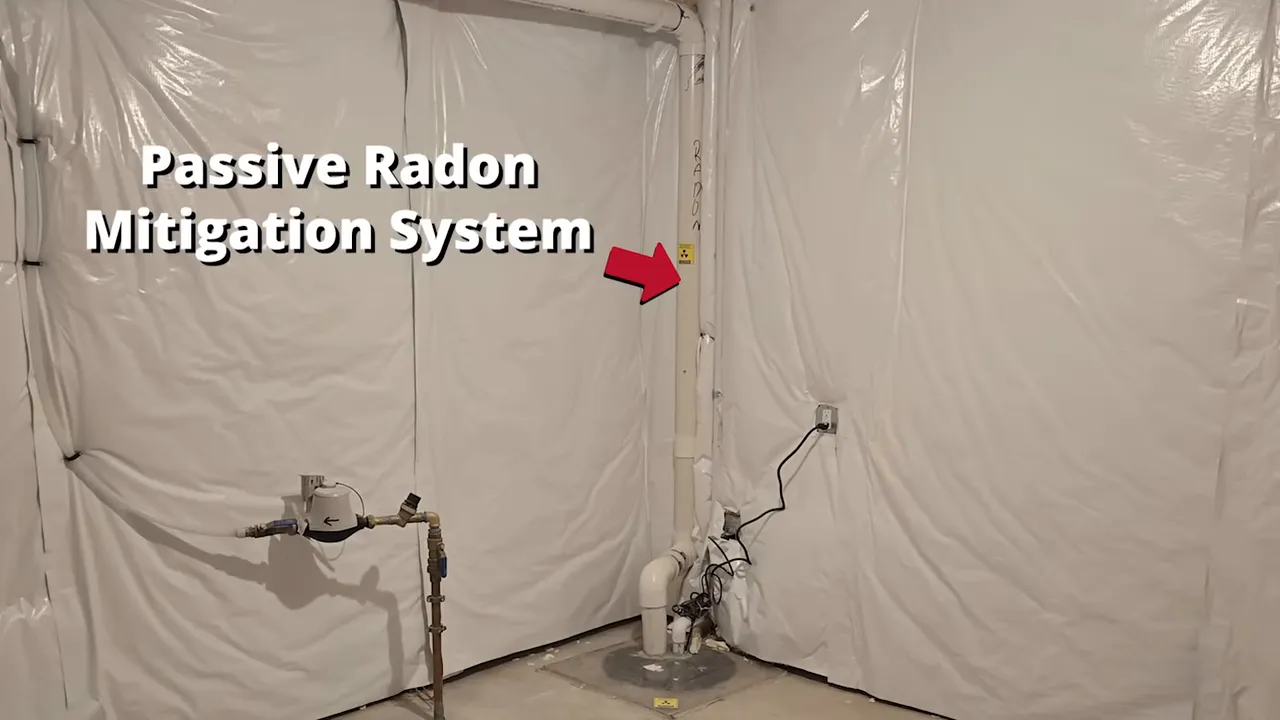

Eastern Nebraska has elevated radon levels in many areas. Radon is a colorless, odorless, naturally occurring gas that increases lung cancer risk. Before buying a house while living in Omaha, test for radon. A multi-day test typically costs between $100 and $200 and will tell you whether mitigation is necessary.

If the reading exceeds 4.0 picocuries per liter, consider asking the seller to install a mitigation system. A typical radon mitigation setup is straightforward: drill a small hole through the foundation, add piping and a fan to vent soil gases safely above the roofline. Installation commonly ranges from $1,500 to $2,000, though some homes can be as much as $5,000.

New construction now often includes a passive radon rough-in. That is a pipe through the slab without a fan. Converting a passive system to an active fan-driven system after closing usually costs only a few hundred dollars. For anyone living in Omaha, radon testing is a low-cost step that avoids health and negotiation headaches later.

Basements in Omaha: Storm Shelter vs. Water Risk

Almost every home here has a basement, and for good reasons. Basements provide safe shelter during tornado season and add usable square footage. But basements also attract water. If a builder digs a hole, rainwater will naturally move toward the lowest point. When living in Omaha, accept that basement water intrusion is often a when-not-if problem unless steps are taken to manage water.

The “holy trinity” of a dry basement is:

- Proper grading that slopes away from the foundation.

- Clear, functioning gutters and downspouts that carry water away from the house.

- Effective underground drainage, typically a drain tile and sump pump on newer homes.

Downspouts should extend several feet away from the foundation. Keep gutters clean—clogged gutters concentrate water and increase hydrostatic pressure on the foundation. Newer homes generally include a perforated drain tile system that collects water and directs it to a sump pump. Older homes may lack this system, which raises the risk of basement seepage and costly repairs.

Also understand the difference between a standard basement and a walkout basement. A walkout basement sits on a sloped lot and has exterior access to the backyard. It often feels more like regular living space and tends to command a premium. A standard basement is fully below grade, which some buyers prefer for security and lower visibility.

Lead, Superfund Sites, and Important Disclosure Steps for Omaha Buyers

Parts of Omaha were historically home to heavy industry. One legacy issue is lead contamination from a former smelting plant that operated for more than a century. That contamination prompted the largest residential Superfund cleanup in the nation. As a result, purchasing a house in certain neighborhoods means acknowledging the cleanup area and reviewing remediation records.

You can check the remediation work done at specific addresses on the local registry. If a house was remediated, records typically show that the EPA removed contaminated soil, replaced it with clean topsoil, and installed new sod. If you are living in Omaha and considering properties built before 1978, pay close attention to lead disclosures. Pediatricians historically asked for zip code information during checkups because certain areas and older houses had higher lead exposure risk.

Investors must follow federal lead disclosure rules when renting pre-1978 housing. Failing to provide proper disclosures and mitigation can lead to significant fines. For many buyers—especially families with young children—avoiding homes built before 1978 can be the simplest solution.

Neighborhoods in Omaha

Omaha is highly neighborhood-driven. Two neighborhoods within the same zip code can have completely different personalities and price points. If you are planning on living in Omaha, do not rely solely on maps or online photos. Rent a car for a few days and drive the streets. Get off main roads and walk block by block. You will quickly learn which neighborhoods match your lifestyle.

Keep an open mind. Different suburbs and parts of the city offer very different experiences. Living in Omaha could mean a self-contained suburb where everything you need is within a few blocks, or it could mean a central urban neighborhood with different trade-offs. Many people relocating find that renting first is a smart strategy. Renting buys time to evaluate schools, commute patterns, and where you want to put down roots.

Omaha Weather and Microclimates

Weather in the region can be extreme and highly localized. Microclimates mean a heavy storm, hail, or tornado can slam one neighborhood while nearby areas see little or no damage. When living in Omaha, expect variability—even within a few miles.

Two important concepts to learn:

- Tornado watch means conditions are favorable for tornadoes; stay alert and be ready to take shelter.

- Tornado warning means a tornado has been seen or detected on radar; take shelter immediately, ideally in a basement or interior room without windows.

Power outages are also a real consideration. The region has experienced large-scale outages that left tens of thousands without power for days. When living in Omaha, factor in emergency planning: generators, food and water supplies, and communication plans during extended outages.

Homeowners Insurance in Omaha

Homeowners insurance premiums in the area can be high relative to the cost of homes. Why? Weather-related losses—hail, wind, tornado—raise insurers’ costs, which get passed on to policyholders. If you own a home or plan to buy and be living in Omaha, check your coverage limits periodically. Property values have climbed, and underinsurance is a common problem.

When a storm hits, do this:

- First call a reputable local roofer or contractor to inspect for damage.

- Only call the insurance company after confirming damage exists.

If you call the insurer repeatedly for “no damage” inspections, those events still become part of your claim history and can affect coverage eligibility or premiums. Also, understand the key difference between replacement cost coverage and actual cash value coverage:

- Replacement cost coverage pays to replace damaged items or roofs at today’s prices minus your deductible.

- Actual cash value (ACV) factors in depreciation; insurers may pay substantially less if the roof or item is older.

Ask your agent which type you have and consider higher limits if your dwelling replacement cost has increased since you purchased the policy.

Car Registration, Taxes, and Transportation Realities in Omaha

Nebraska applies several taxes and fees to vehicle purchases and registrations. If you buy a newer car while living in Omaha, expect the DMV and county fees to add up. Factor those costs into your moving budget.

Public transit is improving but remains limited. Most residents rely on a car for daily life. If you are imagining city living without a vehicle, consider seasonal realities: waiting for a bus during extremely cold winter weather and navigating midday commutes are practical reasons why many households own at least one reliable vehicle.

Omaha Roads, Construction, and the City’s Growth Spurt

Road maintenance is a recurring gripe. Freeze-thaw cycles and spring storms lead to potholes, and growth in some parts of town has not been matched by infrastructure upgrades. Expect construction delays and uneven pavement in growing suburbs.

One notable infrastructure project is a new streetcar line connecting Midtown to downtown. Large public projects often stir debate. Whether you love or dislike the idea, the presence of new transit options and downtown investment signals growth—and occasionally frustration during construction months.

Culture and Community: Why Living in Omaha Feels Different

Omaha blends Midwestern friendliness with a range of political and cultural perspectives. Many newcomers note the slower pace compared with large coastal cities. That slower pace is part of the appeal for people moving here: more time with family, friendlier neighbors, and fewer frenzied commutes.

At the same time, cultural amenities—museums, live music, food scenes, and festivals—are stronger than some expect. If you are serious about living in Omaha, you will likely find events, neighborhoods, and activities that suit a wide range of tastes.

Practical Checklist for Anyone Moving to Omaha

- Budget for property taxes being paid in arrears and ask for clear proration at closing.

- Schedule a radon test during inspections and negotiate mitigation when levels exceed 4.0 pCi/L.

- Inspect gutters, downspouts, and grading to reduce basement water risk.

- Review lead disclosure records for homes built before 1978 or in older industrial neighborhoods.

- Rent for a few months if you can—use the time to learn neighborhoods.

- Confirm homeowners insurance type and limits; consider replacement cost coverage where practical.

- Factor DMV and registration fees into your vehicle budget and plan for a car-centric lifestyle.

- Expect weather variability and prepare an emergency kit and a plan for power outages.

Living in Omaha has many advantages—affordable home prices, strong schools, and a welcoming community. But the small details matter. Understanding tax timing, testing for radon, protecting your basement, and preparing for weather realities will save time, money, and headaches.

If you approach the move with eyes open and a short checklist, you can enjoy everything the city offers while avoiding the most common pitfalls encountered by newcomers. Living in Omaha can be a comfortable, family-friendly experience when you know what to expect.

Have questions about moving to Omaha or want personalized advice on neighborhoods, taxes, or inspections? Reach out — call or text me at 402-490-6771 and I’ll help you sort the details or schedule a time to chat. No pressure, just practical guidance to make your move smoother.

FAQs About Living in Omaha

How are property taxes paid when you buy a home mid-year?

Property taxes are paid in arrears. The last full year’s tax bill is typically prorated at closing so the buyer pays taxes for the portion of the year after closing while the seller pays the portion before closing. Title companies calculate and show this proration on the closing statement.

Should I test for radon before buying?

Yes. Radon testing is inexpensive and important. If the level exceeds 4.0 picocuries per liter, you can ask the seller to install a mitigation system or negotiate credits to cover the cost.

What steps reduce basement water problems?

Maintain proper grading away from the foundation, keep gutters and downspouts clear and extended away from the house, and ensure an effective drain tile and sump pump system if possible.

Are there specific disclosures related to lead contamination?

Yes. Properties in former industrial or Superfund cleanup areas require specific disclosures. Check the local remediation registry for records tied to individual addresses, and follow federal lead disclosure rules for rental properties built before 1978.

Is public transportation a reliable alternative to owning a car?

Public transit is improving but is not yet a reliable substitute for a car for most households. Many residents rely on a personal vehicle for daily needs, especially during harsh winter weather.

How do homeowners insurance claims affect future coverage?

Calling your insurance company for every suspected issue can build a claim history that may affect premiums or coverage eligibility. First confirm damage with a reputable local contractor, then file a claim if there is real damage.

Read More: 10 Myths About Omaha—BUSTED!

DAVID MATNEY

David Matney is a trusted Realtor® and local expert with over 20 years of experience in Omaha’s real estate market.