Moving to Omaha: 9 Things No One Tells You Before You Pack

If you are moving to Omaha, you already know the housing market can feel affordable at first glance. That low sticker price is attractive, but there are important realities that can shift your decision quickly. Below I break down nine practical, sometimes surprising truths that will shape your move to Omaha, help you budget realistically, and give you the confidence to choose the right neighborhood, school, and home for your family.

Table of Contents

- 1. Property Taxes in Omaha: Affordable Homes, Not-So-Affordable Taxes

- 2. Schools and Education in Omaha

- 3. Homeowners Insurance Is Higher in Omaha

- 4. The Omaha Real Estate Market: Stable, But Not Predictable

- 5. Touring Homes: A Signed Buyer-Broker Agreement Is Required

- 6. New Construction in Omaha Is Often a Great Value

- 7. Crime Exists, but Choose Where You Live in Omaha

- 8. Omaha Healthcare Access Is Strong

- 9. Radon and the Lead Superfund Area: Tests and Disclosures

- Moving to Omaha? Practical Next Steps

- Final Thoughts on Moving to Omaha

- Frequently Asked Questions When Moving to Omaha

1. Property Taxes in Omaha: Affordable Homes, Not-So-Affordable Taxes

One of the most common surprises for people moving to Omaha is the property tax situation. Homes in Omaha often cost less than in many big coastal metros, but property taxes are relatively high. Taxes are assessed annually in January, and they are paid in arrears. That means you pay 2025 taxes in 2026. That timing can affect your cash flow during a move and the numbers you see when comparing markets.

Use the Douglas County Assessor site to see exact valuations and mill levies for any property. It is public information and very useful when evaluating an offer. The assessor only values property. When your tax bill arrives, the money is divided among about 11 government entities, and the largest share often goes to the local school district. That is why homes inside certain school boundaries can carry significantly higher total tax bills.

Some new developments are inside Sanitary Improvement Districts also known as SIDs. If you are buying in a SID, your mill levy may be higher because the SID covers bonds used to build streets, sewers, and other infrastructure. New construction can come with unexpected tax increases until the district stabilizes.

Quick tips for taxes when moving to Omaha

- Check the assessor site for the parcel valuation and current mill levy before making an offer.

- Budget for taxes paid in arrears. Closing in one year does not mean that year’s tax bill is gone.

- Expect different tax levies across neighborhoods and developments. Ask whether the property sits in a SID or other special district.

2. Schools and Education in Omaha

If you are moving to Omaha and schools are a priority, plan to research beyond rankings. Nebraska uses open enrollment, but it requires applications and available space. Rapid growth in parts of the metro, especially Southwest Omaha, means many schools are near capacity and boundaries can change as new schools open.

Find up-to-date information at the Nebraska Education Profile site. Classification labels—excellent, great, good, need support—give a starting point, but school culture and fit often matter more than a single rating. If possible, schedule an in-person visit to feel the school environment. Private school options are also plentiful and worth exploring.

School planning checklist

- Verify the current boundary for the property before putting in an offer.

- Check open enrollment rules and capacity for your desired schools.

- Visit or call the school to ask about programs, class sizes, and culture.

3. Homeowners Insurance Is Higher in Omaha

Weather drives insurance costs. Omaha gets thunderstorms and hail during spring and summer. Hail is frequent and can be costly. When moving to Omaha, one of the first questions to ask about any home is, "How old is the roof?" Insurers are stricter than ever. If a roof is older than a few years or uses vulnerable materials such as wood shake, coverage may be limited or unavailable.

Understand the difference between replacement cost coverage and actual cash value coverage. Replacement coverage will get the damaged part replaced minus deductible. Actual cash value coverage factors in depreciation. For an older roof, you might receive a check for far less than the replacement cost and pay the balance yourself. Always contact an insurance agent right after you go under contract and confirm coverages, deductible expectations, and roof requirements.

4. The Omaha Real Estate Market: Stable, But Not Predictable

Moving to Omaha means entering a market that tends to be stable compared with many U.S. cities. Property values have climbed; median sale prices have increased significantly over the past several years. Interest rates and insurance rates are also important variables.

No one can predict where prices or rates will go. The Omaha market historically avoids violent swings, but there is still risk. If you plan to buy a home in Omaha and resell within a short time frame, factor in carrying costs, maintenance, and the possibility you might sell at a loss. For many people, renting first makes more sense while they learn neighborhoods and let the market clarify.

- If you will be in town part time, renting may be better than buying.

- Do not confuse pre-approval with affordability. Buy a home you can truly live in when taxes and insurance rise.

- Budget 1 to 3 percent of home value per year for maintenance on older homes.

5. Touring Homes: A Signed Buyer-Broker Agreement Is Required

If you are moving to Omaha and you plan to tour properties, note that a signed buyer-broker agreement is required before agents can show you homes. This law went into effect to clarify compensation and representation. Read any agreement carefully. Terms are negotiable. You can seek a limited agreement for a single property as a test drive if you are unsure about committing long term.

When you make an offer you can request the seller pay for your agent compensation. Many sellers expect to do so, but not all will agree. Be prepared that if the seller refuses, you may owe your agent’s fee as negotiated in your buyer-broker agreement.

6. New Construction in Omaha Is Often a Great Value

Many buyers moving to Omaha are surprised at how much house they can get for the price in new subdivisions. New builds frequently include appliances, sprinkler systems, better insulation, and sometimes impact-resistant roofing that reduces insurance costs.

Not all new homes appear on major listing portals. Builders sell directly and maintain model homes. If you are open to new construction, consider touring local builders. A new house can be a particularly smart option for buyers who value lower maintenance and modern systems.

- Respect builder policies: if you are working with an agent, do not visit a model home for the first time without that agent present.

- Ask what is included: appliances, landscaping, storm-rated shingles, and energy features can change the long-term cost of ownership.

- Timing tip: if a builder’s timeline is nine months, you can rent during that period rather than rush a purchase.

7. Crime Exists, but Choose Where You Live in Omaha

Crime is a reality in any metro. The important question for someone moving to Omaha is which neighborhoods meet your comfort level. As a buyer, you get to choose where to live. Agents must avoid steering and respect fair housing rules, so do your own exploration. Spend a day driving neighborhoods, check local crime maps, visit retail corridors, and observe how a place feels at different times of day.

Renting for a year while you explore can be a smart strategy to learn where you feel most comfortable. Omaha has neighborhoods ranging from urban to suburban, each with different vibes and price points. Take your time to find the right match for your lifestyle.

8. Omaha Healthcare Access Is Strong

If you are moving to Omaha and healthcare access matters, the metro delivers. Nebraska Medicine and the University of Nebraska Medical Center provide major specialty services including cancer care, transplant, cardiology, and infectious disease treatment. There are large hospitals and clinics across the metro so specialized care is nearby for most residents.

For families moving from rural areas or smaller towns, this level of access is a major advantage and something to weigh when choosing Omaha as a new home base.

9. Radon and the Lead Superfund Area: Tests and Disclosures

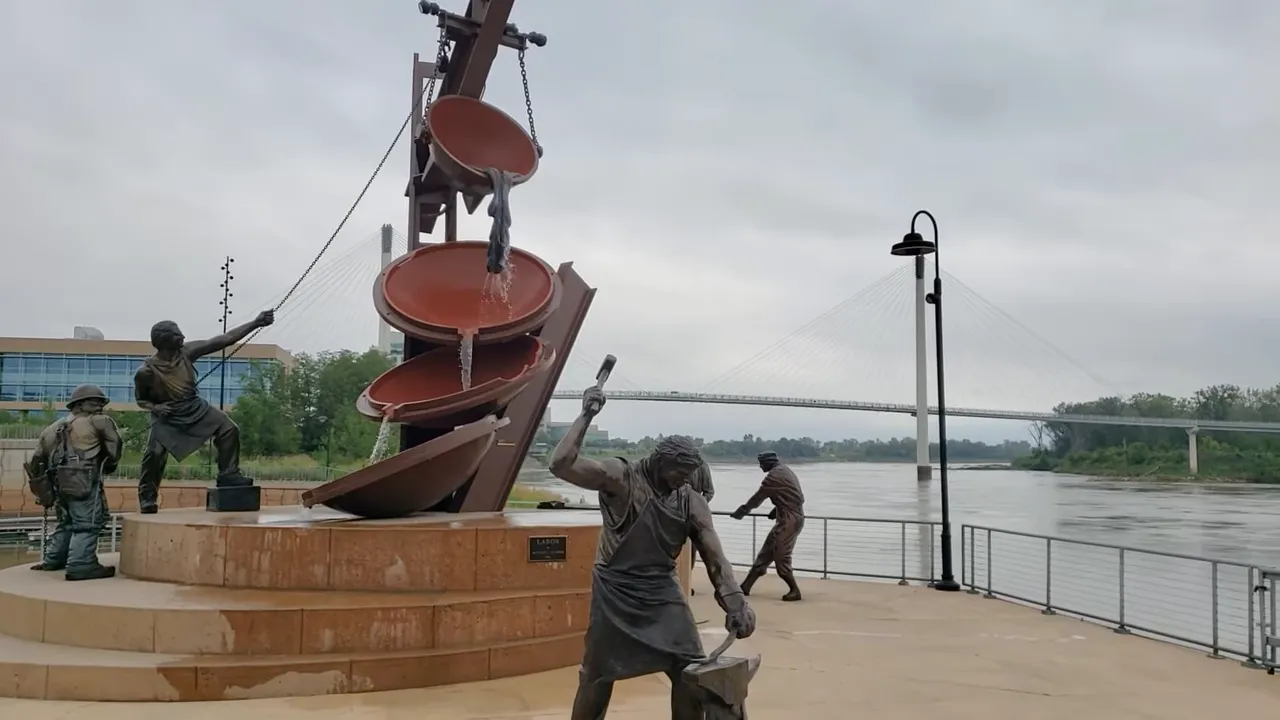

Two environmental issues are important for those moving to Omaha: radon and the historical lead contamination from the old smelting plant near the riverfront.

The riverfront area, home to the Bob Kerrey pedestrian bridge and recent redevelopment, was once contaminated by a lead smelting plant. The site becomes a disclosure item when you purchase inside the designated area. If you are considering properties in those neighborhoods, be prepared to sign a lead site disclosure and read the documentation carefully.

Eastern Nebraska has high radon potential. Radon is the second leading cause of lung cancer behind smoking. A radon test costs roughly one to two hundred dollars as an add-on to a home inspection. New construction often comes with a passive radon mitigation block. Converting from passive to active typically requires adding a fan and costs a few hundred to a couple of thousand dollars depending on the home. Always include a radon test in your inspection add-ons when buying.

Moving to Omaha? Practical Next Steps

If you are moving to Omaha, here are practical steps to reduce surprise and stay in control of the process:

- Run the address through the county assessor to check valuations and mill levies.

- Verify school boundaries and capacity via the Nebraska Education Profile.

- Ask about roof age, insurance requirements, and whether impact-resistant shingles are installed.

- Add a radon test to your inspection list and review any lead disclosures for the property.

- Compare new construction options; sometimes you can get more for your money with a new build.

- Plan whether renting for a year makes sense while you learn the city and wait for a build to finish.

Final Thoughts on Moving to Omaha

Moving to Omaha comes with real advantages: reasonable home prices, good healthcare, solid schools, and growth opportunities. But "reasonable price" does not mean no surprises. Property taxes, insurance, maintenance, and occasional environmental issues are factors that weigh heavily on the total cost of living here.

Be methodical. Do the math. Visit neighborhoods. Add radon testing and careful insurance review to your checklist. Consider new construction as a legitimate option when comparing value. If you are moving to Omaha with children, verify school boundaries and plan for possible enrollment constraints. Taking these steps makes the move smoother and helps avoid costly surprises after you sign the papers.

View Homes For Sale in Omaha, NE

Frequently Asked Questions When Moving to Omaha

How do property taxes work if I am moving to Omaha?

Taxes are assessed each January and paid in arrears. That means you pay the previous year’s taxes the following year. Mill levies vary by parcel and most of the tax revenue goes to local school districts. Use the county assessor site to check the valuation and levy for any address before making an offer.

Should I test for radon when buying a home in Omaha?

Yes. Eastern Nebraska has elevated radon levels. A radon test costs about $100 to $200 as an add-on to the home inspection. If levels are high, installing a mitigation system is a proven fix and new homes often include a passive system that can be upgraded.

Are homeowners insurance rates high in Omaha?

Insurance tends to be higher because of frequent hail and storm activity. Roof age and material affect availability and type of coverage. Confirm coverage early after you go under contract and understand the difference between replacement cost and actual cash value policies.

Is new construction a good option for people moving to Omaha?

Often yes. New homes can include appliances, modern systems, storm-rated shingles, and lower immediate maintenance costs. Many builders offer competitive pricing compared with the existing home market, and some builders do not list on major portals so you might find deals by contacting builders directly.

How should I choose a neighborhood when moving to Omaha?

Spend time driving neighborhoods at different times, check crime maps, visit retail and dining areas, and consider school boundaries. Renting for a year while you learn the city is a low-risk strategy to find a neighborhood that matches your lifestyle.

Do I need a buyer-broker agreement to tour homes?

Yes. A signed buyer-broker agreement is required before touring properties. Read the agreement carefully as terms are negotiable. You can negotiate limited agreements or short-term testing agreements if you are unsure about long commitments.

What environmental disclosures should I watch for?

Properties inside the Omaha lead superfund area require a lead site disclosure. Also request testing or documentation for radon and any remediation history. Ask sellers for records of environmental testing and mitigation systems when available.

Is Omaha a small town or a big city?

The Omaha metro is over one million people. It has many of the amenities of a larger city including specialty healthcare, cultural institutions, professional sports events, and diverse dining. The city offers a balance of urban amenities and midwestern affordability.

DAVID MATNEY

David Matney is a trusted Realtor® and local expert with over 20 years of experience in Omaha’s real estate market.