Why Buying a Home Feels Like a Scam in 2026

Table of Contents

- The Reddit Post That Started the Question

- What Rent and Mortgage Actually Buy

- Interest Rates and the Possibility of Refinancing

- Property Taxes: How They Work and Why They Hurt the Comparison

- Equity Matters Even If You Never Sell

- Renting for Flexibility vs Buying for Stability

- Debt, Credit Cards, and the Real Barrier to Homeownership

- How to Decide If This Specific Home Makes Sense for You

- Rental Property and Private Equity: The Reality Check

- Local Markets Matter

- Practical Checklist Before You Buy

- FAQs

The Reddit Post That Started the Question

Two people, late 20s, combined gross income about $140,000, paying $1,800 rent for a one-bedroom. They look at a 3-bedroom for $350,000 and the mortgage number on the table is roughly $3,000 per month at a 6.7 percent rate. The gut reaction: this feels like a scam.

That reaction is real and understandable. The true question is not whether home buying is a scam in the abstract. The question is whether that specific house, at that specific price and financial situation, is a sensible decision.

Why a Mortgage Feels So Much Worse Than Rent

People anchor to the rent they are paying now. They compare that number to a mortgage and experience immediate sticker shock. But anchoring to a single number misses the rest of the picture.

Monthly mortgage payments include principal, interest, taxes, and insurance. Rent usually bundles utilities and maintenance, but it does not buy equity, cannot be refinanced by the tenant, and does not offer the same tax and control benefits.

Quick math: $140,000 gross is about $11,600 per month before taxes. A $3,000 all-in housing cost is roughly 25 percent of gross income. That is within many affordability guidelines, but affordability is personal and depends on other debts, lifestyle, and comfort level.

What Rent and Mortgage Actually Buy

- Rent: flexibility, fewer maintenance responsibilities, and short-term predictability (until rent increases).

- Homeownership: space, privacy, a yard, control over the property, potential appreciation, tax deductions for mortgage interest (in many situations), and the ability to build equity.

Comparing $1,800 for a one-bedroom versus $3,000 for a three-bedroom is not comparing the same product. If you need space, a garage, and a yard, the higher number might be justified. If you do not need those things, buying may be the wrong move.

Interest Rates and the Possibility of Refinancing

Interest rates have fluctuated a lot in recent years. After hitting highs, rates dropped from earlier peaks, and 30-year fixed rates in the current market are in the mid 6 percent range. That can change.

Refinancing is an option if rates drop significantly. But refinancing is not guaranteed and costs money. Treat any future refinance as a potential, not a plan you can rely on when buying.

Property Taxes: How They Work and Why They Hurt the Comparison

Property taxes are ad valorem. They are based on assessed value times the mill levy. Local governments set budgets, and assessments adjust with market values. So yes, property taxes can and do go up.

Important points:

- Tax increases are not only a buyer problem. Renters pay indirectly through rent increases when landlords pass costs on.

- Different counties and school districts set different mill levies. Two homes in the same city can carry very different property tax bills.

- Plan for rising taxes and insurance. These are recurring costs that can increase over time and affect monthly affordability.

Do You Actually Own the Home for 30 Years?

Ownership begins the day the deed transfers. The bank holds a lien as collateral for the loan, but that does not negate ownership. The risk is foreclosure if payments stop. The point that "you do not own it for 30 years" confuses legal ownership with lender security interests.

Equity Matters Even If You Never Sell

Equity is not just a number you cash out when you sell. It is a financial tool that enables options:

- Home equity lines of credit for emergencies or renovations.

- Borrowing against built-up equity for college or other major expenses.

- Using equity as leverage to buy an investment property or to consolidate higher-cost debt—carefully.

That said, using your home equity as an ATM is risky. Consolidating credit card debt into a mortgage-backed line only helps if the underlying spending behavior changes.

Renting for Flexibility vs Buying for Stability

There are perfectly valid reasons to continue renting:

- Short time horizon in an area (less than five years).

- Uncertain job or lifestyle changes.

- High maintenance costs or deferred maintenance in houses on the market.

Buying makes more sense if you plan to put down roots, want control over the property, and can comfortably afford the total cost including taxes, insurance, and maintenance.

Debt, Credit Cards, and the Real Barrier to Homeownership

High-cost consumer debt is a stealth killer for homebuying plans. Average credit card interest rates are eye-popping—over 25 percent in recent data. Paying off high-interest debt should be priority before stretching to buy rental or primary residences.

If credit card debt is earning 25 percent interest, paying it off is a guaranteed return you cannot easily beat in most investments. That improves debt-to-income ratios and mortgage qualifications.

How to Decide If This Specific Home Makes Sense for You

Ask these direct questions and be brutal with answers:

- How long will I live in this home? Less than five years suggests renting or waiting.

- What other debt do I carry? Pay off high-interest debt first.

- Can I handle a 10 to 20 percent fluctuation in taxes, insurance, or vacancy if it is an investment?

- Do I have an emergency fund to cover repairs and unexpected expenses?

- Am I buying because I need space and stability or because I am chasing an investment return?

Always choose a mortgage amount you are comfortable paying even if a lender qualifies you for more. Comfortable equals sustainable.

Rental Property and Private Equity: The Reality Check

Large private equity firms grabbing headlines are active in certain markets, but they do not own the majority of housing stock nationwide. Owning and managing rentals is not simple passive income. Older homes have maintenance cycles that can quickly turn profits into stress.

If you plan to become a landlord, run worst-case scenarios. Could you survive if half your units were empty? Use conservative assumptions about vacancy and maintenance.

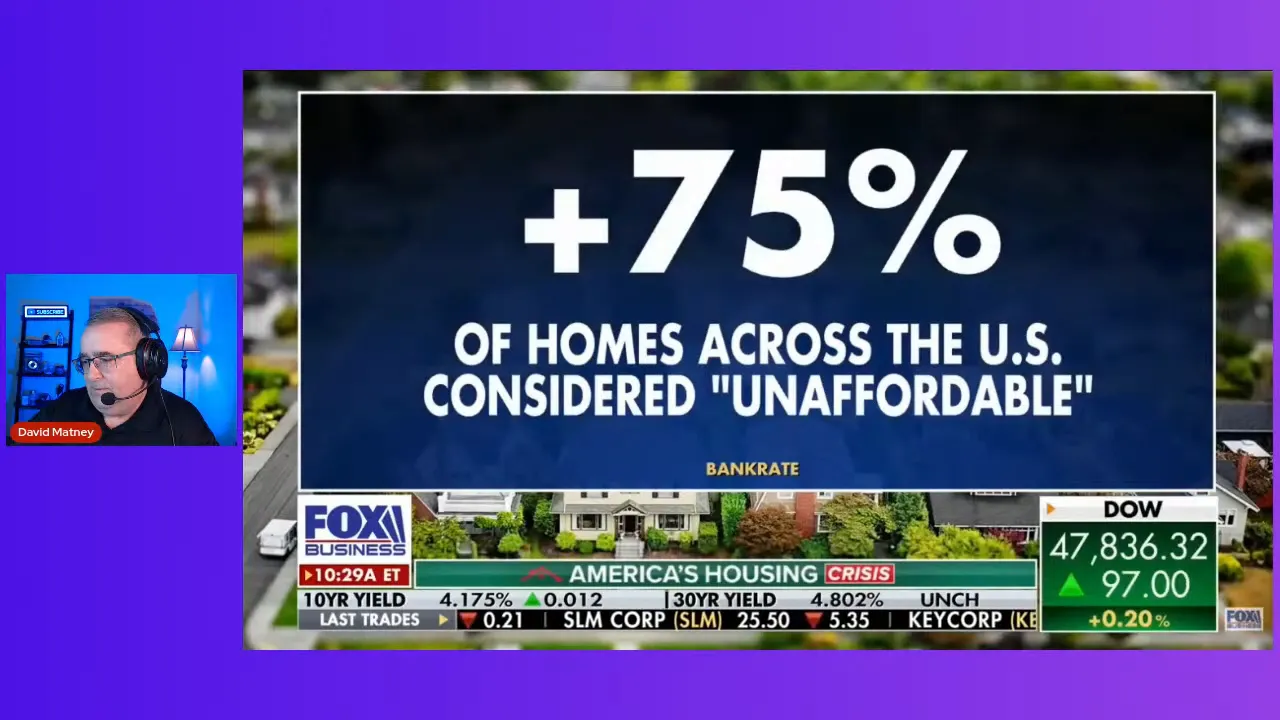

Inflation and Why Wages Did Not Keep Up

Inflation pushed prices up sharply post-2020. Interest rates were raised to cool inflation, which increased mortgage rates. Home price appreciation, higher taxes, and increased insurance combined with slow wage growth are the root drivers of current housing unaffordability.

Local Real Estate Markets Matter

National headlines on housing often mask enormous local differences. Some suburbs, for example, show extreme demand and low inventory. Other markets have more land, ongoing development, and lower prices per square foot.

To illustrate extremes, look at high-end mountain markets versus Midwestern cities:

- Aspen: an extreme example of concentrated wealth, where condos under a million have HOA fees that are surprisingly high, and luxury listings reach double-digit millions. These markets behave differently from mainstream metro areas.

- Omaha: more land, active new construction, and far greater buying power for the same dollar amount. Three million in Omaha buys a very different home than three million in Aspen or Westchester.

Practical Checklist Before You Buy

- Run the full numbers: principal, interest, taxes, insurance, HOA, maintenance, and utilities. If you are comparing to rent, add what those renters typically pay for utilities and services.

- Get preapproved but choose a price line comfortably under your maximum qualifying amount.

- Build an emergency fund equal to three to six months of living expenses plus a home repair buffer.

- Pay off or reduce high-interest consumer debt first.

- Plan to stay at least five years to ride out transaction costs and market swings.

- Check local tax trends and school district levies before choosing a neighborhood.

- Be realistic about maintenance, especially if the house is older.

Home buying in 2026 feels like a scam to many because of payment shock and rising costs. The feeling is valid. The reality is nuanced:

- For some households, renting is the smarter, less risky choice right now.

- For others, buying still makes sense when the numbers match the long-term goals: space, stability, and an ability to weather rising taxes and insurance.

- Ownership starts day one. Equity is a tool, not just a final payout when you sell.

- Local market dynamics matter more than national headlines.

The honest answer to whether buying is a scam: it depends. It depends on the house, the price, the market, your debt, your horizon, and how comfortable you are with the monthly payment and long-term responsibilities.

If you have questions or need help deciding whether to rent or buy — especially in the Omaha market — I can help with numbers, neighborhood guidance, tax and school info, and a clear plan that fits your timeline. Reach out anytime: Call or text 402-490-6771. You can also email davidmatney@nebraskarealty.com or visit LivinginOmaha.com.

FAQs

How should I compare rent and mortgage payments?

Compare total monthly costs for each option, not just principal and interest. Include taxes, insurance, HOA fees, utilities, maintenance, and the value of flexibility. Factor in equity build and tax benefits for ownership.

When is renting the smarter option?

Renting is smarter when you expect to move within five years, your job or income is unstable, maintenance costs on available homes are prohibitively high, or you carry high-interest consumer debt that needs payoff first.

Do property taxes only affect homeowners?

No. Landlords often pass tax increases to renters through higher rent. Homeowners, however, directly control property choices and tax-credit options, while renters have less control over how increases get handled.

Can I rely on refinancing to lower my mortgage payment later?

Refinancing is possible but not guaranteed. It comes with transaction costs and depends on future rates, market conditions, and your credit profile. Treat it as potential upside, not a certainty when deciding whether to buy now.

How long should I plan to stay in a home to make buying worthwhile?

A minimum of five years is a common rule of thumb to offset transaction costs and give time for equity to build. The longer you stay, the more likely ownership will be financially advantageous.

Read More: 2026 Housing Market Update: The First Signals Are Already Here

DAVID MATNEY

David Matney is a trusted Realtor® and local expert with over 20 years of experience in Omaha’s real estate market.