Omaha Housing Market: October Signals, What Changed, and Why Buyers Should Pay Attention

The Omaha housing market is sending a clearer signal than it has in months. October showed three big signs the market is shifting: more homes are sitting longer, prices are behaving differently between new construction and existing homes, and sellers are starting to negotiate again. None of this points to a crash, but it does point to a return to a more normal, balanced Omaha housing market — and that can be the best kind of opportunity for buyers who know where to look.

Table of Contents

- Three headline signs the Omaha housing market is changing

- Inventory deep dive: more homes, and what that actually means

- Omaha real estate pricing: New builds and existing homes

- Omaha home sales, demand, and how interest rates factor in

- Macro inputs that affect the Omaha housing market

- Omaha market update: Months of supply and days on market

- Practical strategies for sellers in the changing Omaha housing market

- Practical strategies for buyers in the changing Omaha housing market

- Why this is not a crash

- Neighborhood and price point nuance

- Data highlights at a glance

- FAQs about Omaha housing market

- Bottom line

Three headline signs the Omaha housing market is changing

If you only had time for a quick summary, here are the three biggest things I want you to remember about the Omaha housing market right now.

- Inventory is up and homes are sitting longer than they have in months. That gives buyers more options and a little more negotiating leverage.

- Price movement is mixed. New construction is showing small gains while the existing market is essentially flat. That split matters for buyers and sellers depending on which segment they are in.

- Sellers are starting to blink on price and concessions are returning to transactions. That means inspection requests, repairs, and occasional closing cost help are back in play.

Inventory deep dive: more homes, and what that actually means

Let's get granular. Right now, the Omaha housing market has 2,415 homes actively listed across Douglas and Sarpy counties. That total is up 15.4 percent compared to last year. But the split between new construction and existing homes tells an important story.

New construction listings: 946 active homes. That number is actually down 4.6 percent year over year. Builders are sensitive to the market. If they sense a slowdown they pause or slow starts to avoid having spec homes sit unsold. Remember, many of those 946 listings are at different stages: some are lots, some are framed, and others are fully complete homes sitting ready for buyers.

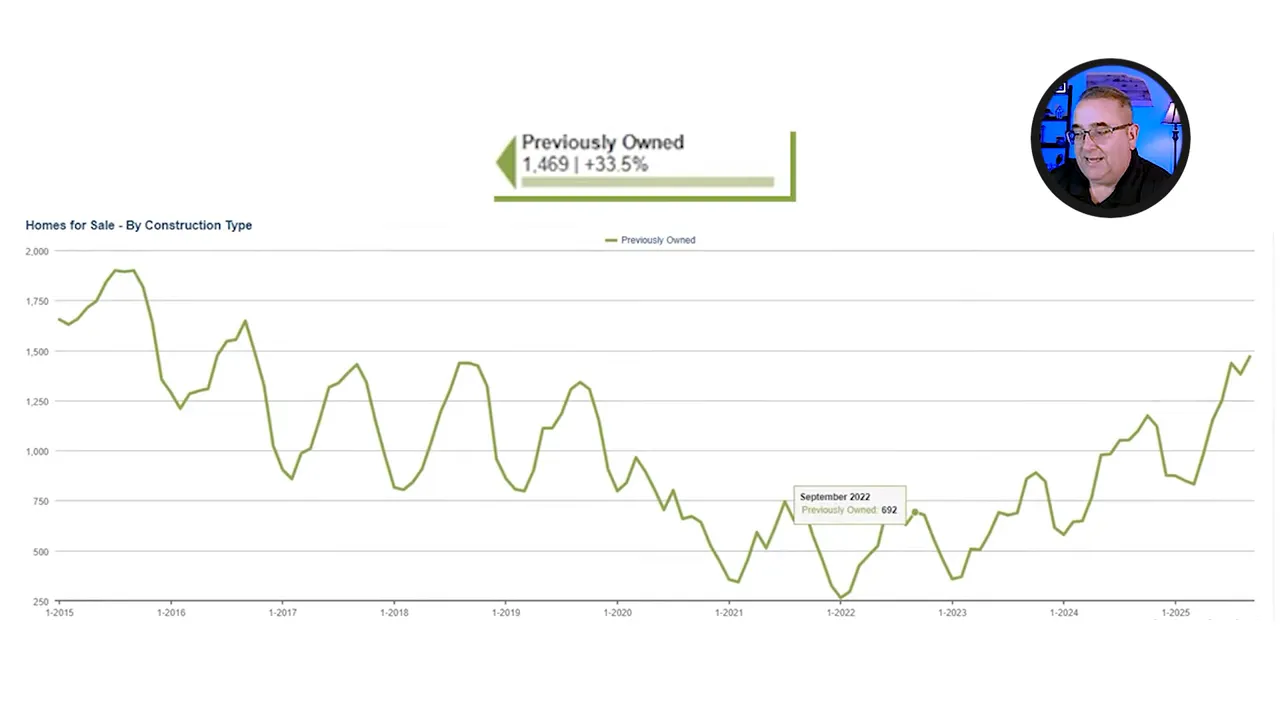

Existing home listings: 1,469 active homes, which is up a notable 33.5 percent year over year. That is a meaningful shift. For five years leading up to this change, the biggest complaint I heard was lack of inventory. Suddenly, that pressure is easing toward more typical pre-pandemic conditions.

Three years ago, in September 2022, the area had only 692 homes on the active market. That scarcity combined with very low mortgage rates produced the extreme seller-favorable conditions everyone remembers. What we are seeing now is more like the market that existed before the pandemic: more options for buyers and fewer runaway bidding wars.

Why more inventory changes the rules of the game

More inventory in the Omaha housing market means several behavioral shifts:

- Homes take longer to sell. The days-of-market clock becomes a more relevant indicator of buyer interest.

- Inspections and repair requests return as standard parts of the process. Buyers feel comfortable asking for items to be fixed or for credits at closing.

- Bidding wars and multiple-offer situations become less frequent. They still happen in hot pockets, but they are no longer the default.

- Sellers who price like it is 2021 or 2022 will find their homes sitting, sometimes for weeks.

Omaha real estate pricing: New builds and existing homes

Prices tell only half the story. Here are the latest median sale numbers that help explain what buyers and sellers are doing in the Omaha housing market.

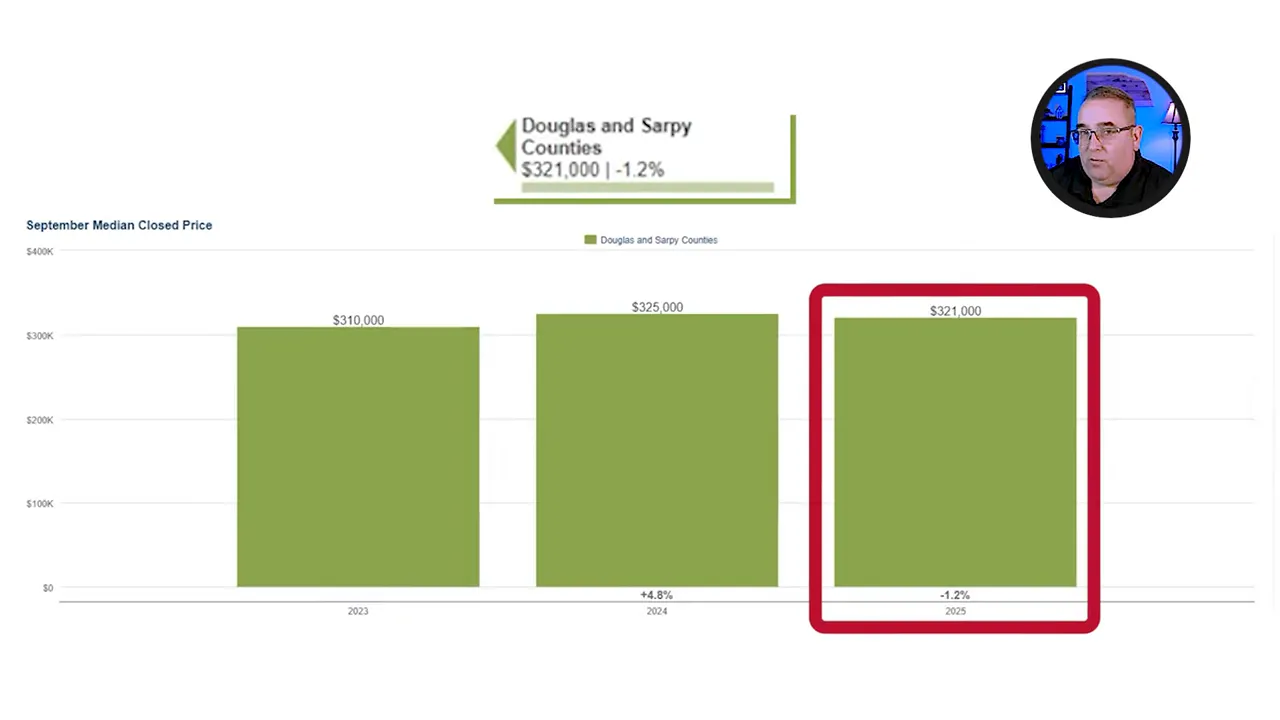

The combined median sale price for the month was $321,000, down 1.2 percent compared to a year ago. That headline number hides variation between new construction and existing sellers.

New construction median sale price: about $430,575, which is up roughly 3.2 percent year over year. New build pricing has backed off from a peak in mid-2023 but is showing some uptick again.

Existing home pricing is essentially flat to last year. Across many neighborhoods and price points there is not a dramatic decline in values. Instead we have stabilization and localized softness in places where inventory and days on market have shifted the most.

Looking at the 12-month rolling average smooths the month-to-month noise: new construction in green and existing in red show different patterns. New construction peaked in July 2023 and pulled back, while existing homes have shown steady increases over the past decade and are now leveling out.

Price per square foot snapshot

Price per square foot gives another useful perspective. In the Omaha housing market, new construction averages about $257 per square foot, while existing homes average about $216 per square foot. Existing market price per square foot is up around 3.8 percent on a rolling 12 month basis.

Omaha home sales, demand, and how interest rates factor in

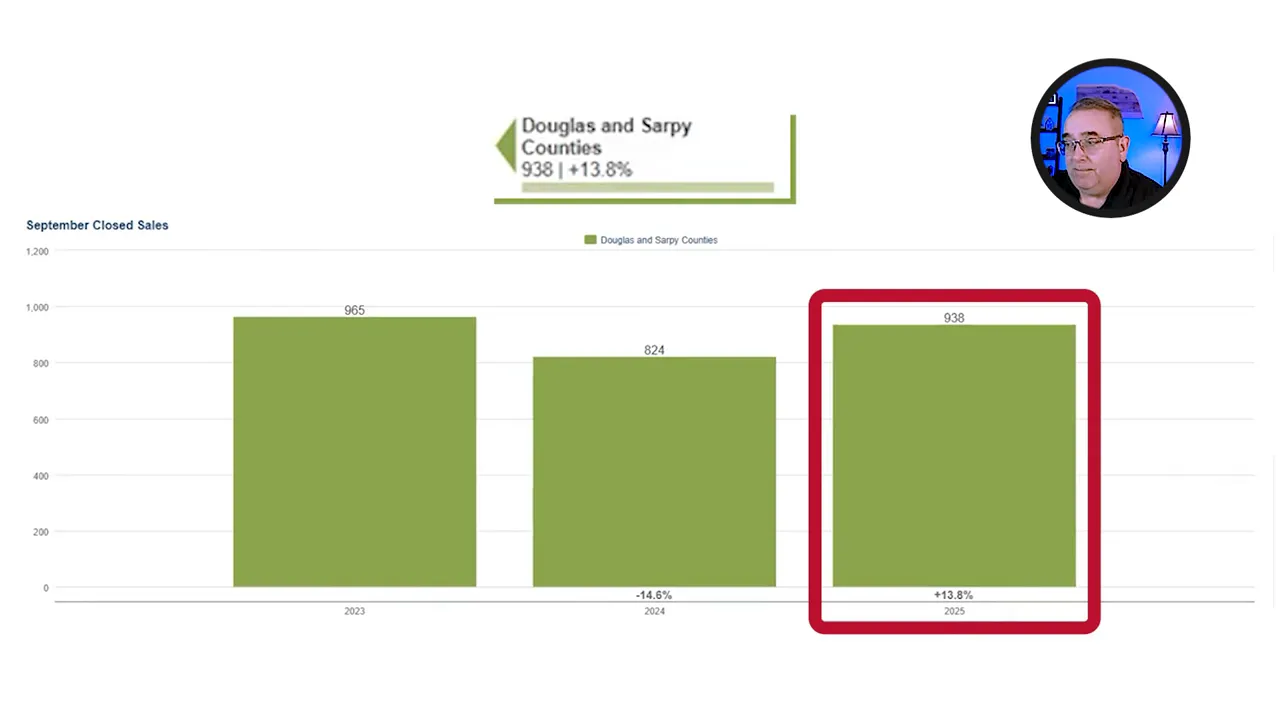

Price trends can look one way but demand tells another side of the story. In September, closed sales were up 13.8 percent year over year. Last month there were 938 closed sales. That increase in sales shows demand is still very much present — especially when interest rates move in buyers favor.

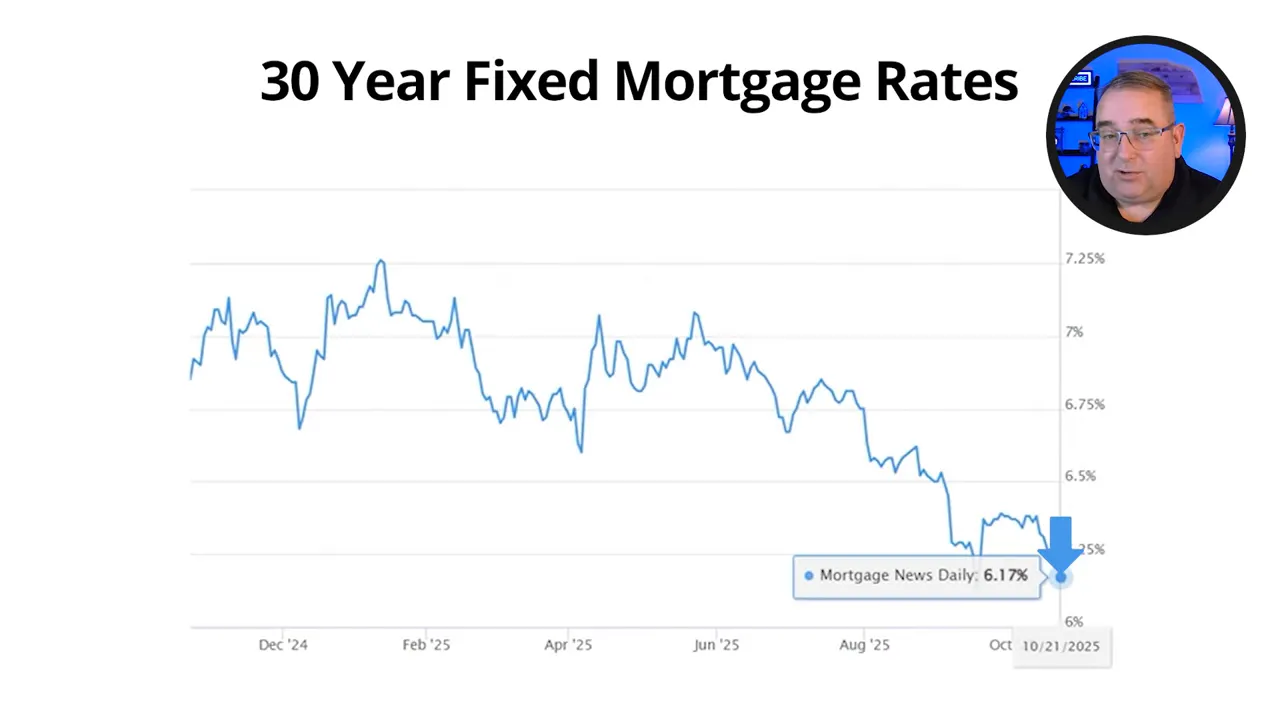

Interest rates matter. When rates fall, borrowing costs decline and monthly payments become more affordable. That pushes some buyers back into the market. The 30-year fixed mortgage rate moved toward the lower levels seen this year and is currently around 6.17 percent. That is lower than earlier in the year and it made homes more attractive to those who were waiting on rates to move.

A couple of practical notes about rates and timing in the Omaha housing market:

- Trying to perfectly time interest rates is unreliable. Nobody knows for sure where rates will be six months from now.

- If you can afford a home today and you plan to stay in it for at least five years, buying now typically makes sense. If rates drop later you can refinance but do not count on that outcome as your primary plan.

- Ultra-low rates like 2 or 3 percent are unlikely to return. Buyers and sellers need to plan around current realistic ranges, not nostalgic extremes.

Macro inputs that affect the Omaha housing market

The local market responds to national forces. A few pieces of macro data are worth watching because they influence mortgage rates, builder decisions, and buyer confidence.

- 10-year Treasury yield drives long term mortgage rates. In times of economic uncertainty investors flock to bonds, which raises bond prices and lowers yields. Lower yields tend to push mortgage rates down.

- Inflation matters. The most recent reading was about 2.9 percent for August. The Federal Reserve wants inflation near 2 percent. If inflation remains above target, the Fed will be less likely to cut short-term rates.

- Unemployment affects housing demand. National unemployment is around 4.6 percent, Douglas County is approximately 3.12 percent, and Sarpy County sits near 2.8 percent. Healthy local employment supports housing demand.

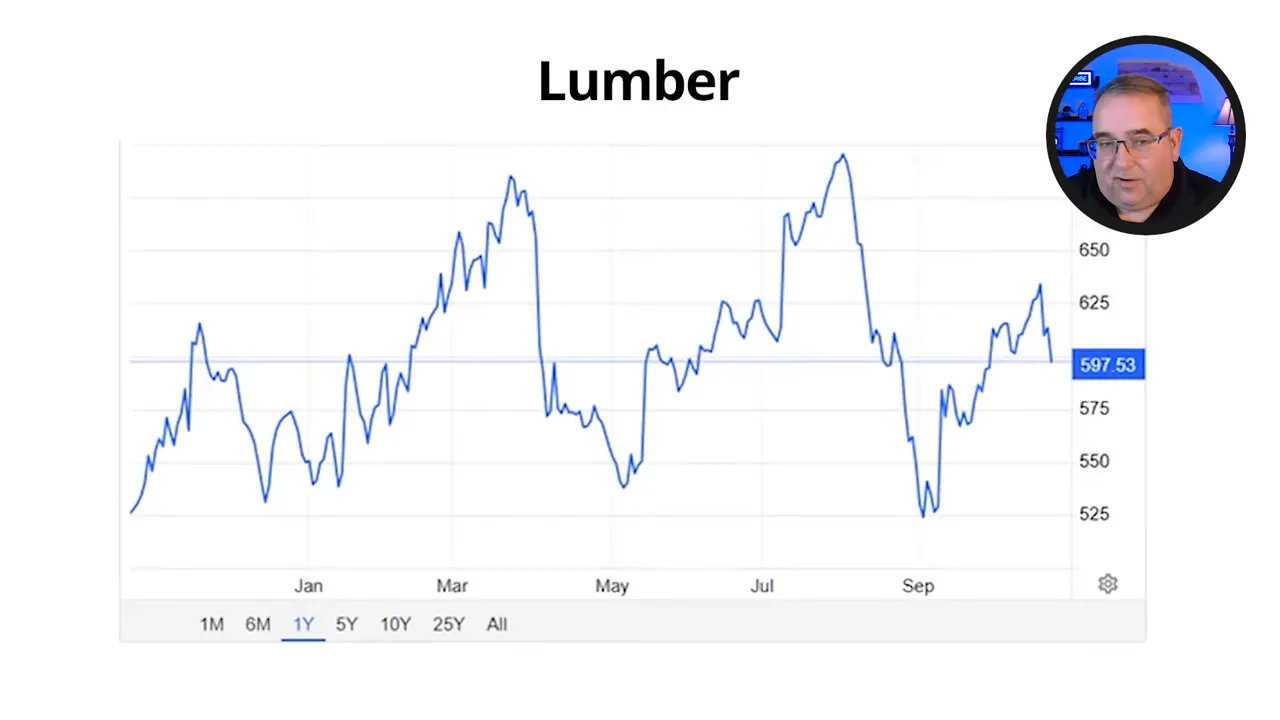

- Lumber and material costs matter for builders. When rates fall and demand rises, lumber prices can climb. Lumber is currently around $597 per 1,000 board feet, which factor into new build pricing and builder margins.

Politics can also indirectly affect the market through Fed leadership and policy expectations. Jerome Powell has been a hawkish presence focused on inflation control. Leadership changes at the Fed could shift policy direction over time, so that is something to keep an eye on through 2026 and beyond.

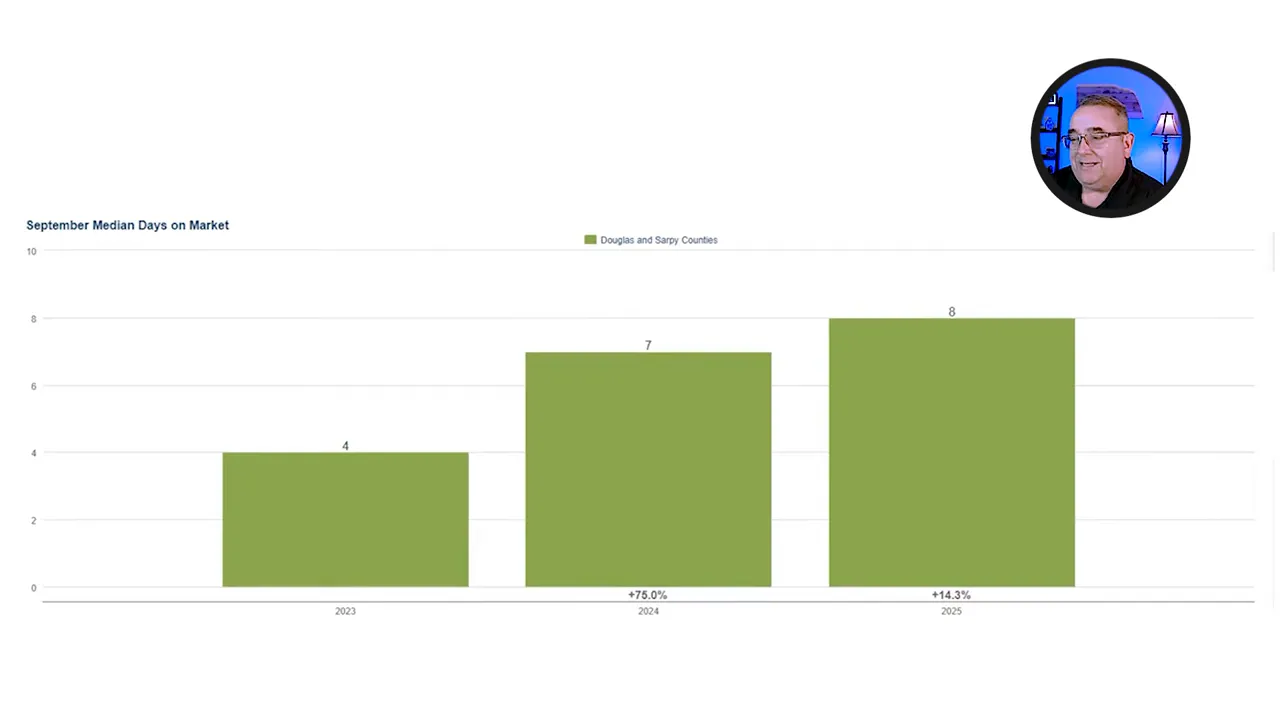

Omaha market update: Months of supply and days on market

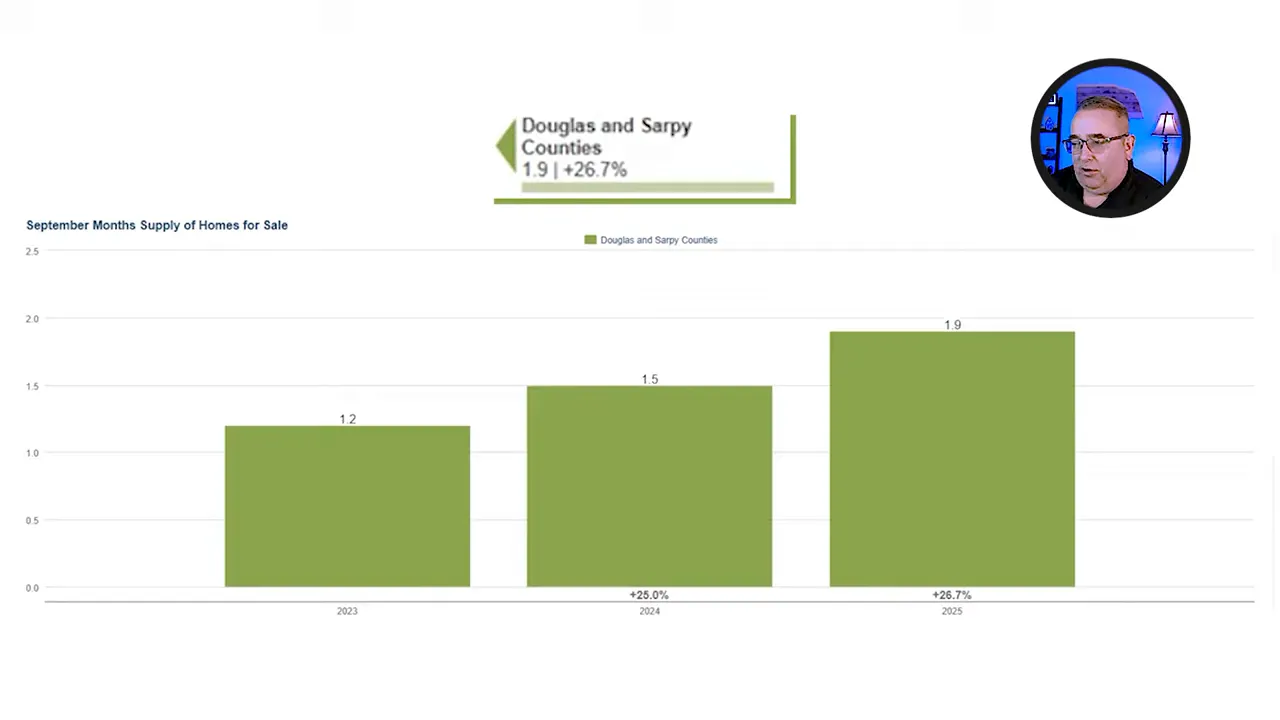

Months of inventory is a simple supply-demand gauge. A buyer market is typically defined as six months or more of inventory. A seller market is three months or less. Right now, the existing home market in this area sits at about 1.9 months of inventory.

That means we are still in seller territory, but the margin has compressed from the pandemic extremes. Here are two related metrics every buyer and seller should watch:

- Median days on market for existing homes: eight days. Half of sold homes went under contract in eight days or less. That can still feel fast to buyers, but it is significantly slower than the frenetic pace of 2020 to 2022.

- Seasonal inventory cycles: inventory tends to peak in the fall and then shrink through the holidays and winter. Expect more listings to return in spring. Fall can present windows of opportunity as sellers get discouraged and builders look to clear inventory.

Practical strategies for sellers in the changing Omaha housing market

If you are selling a home in today's Omaha housing market, these are the most important tactical considerations.

- Price it right from day one. The first 7 to 14 days on the market generally capture the most buyer attention. Overpricing early kills momentum.

- If you need to reduce the price, make a meaningful reduction. A small trim will often fail to attract new buyers. For example, a $5,000 reduction on a $425,000 listing rarely changes buyer perception. A larger reduction gets attention. Think in larger increments that move the listing into a new search bracket or buyer pool.

- Be prepared for inspections and requests for repairs. Concessions like seller-paid closing costs are back in play, so include those possibilities in your net proceeds calculations.

- Stage and market aggressively during the early list window. Professional photos, accurate pricing, and strong marketing create early urgency and can still produce multiple offers in the right situations.

Practical strategies for buyers in the changing Omaha housing market

Buyers have more leverage than they did two years ago. Here are practical steps to make the most of this moment in the Omaha housing market.

- Get preapproved and know your true budget. Interest rates have improved this year, but affordability remains a factor, so lock in financing plans early.

- Be ready to act quickly on well-priced homes. Median days on market can still be fast in desirable neighborhoods.

- Consider fall buying opportunities. Builders sometimes discount or offer incentives to clear inventory before year end. If you are looking at new construction, bring your agent on your first model visit. Most builders require the buyer's agent to be present on the initial visit to protect your representation rights.

- Think about a five-year horizon. If you plan to live in the home at least five years, the purchase is likely to ride out normal market swings. If rates drop later, refinancing is an option, but it should not be the only reason to buy.

- Negotiate repairs and concessions sensibly. With inspections back in the standard playbook, request what is reasonable and be prepared to compromise.

Why this is not a crash

There is a lot of sensational language online about markets tanking. The facts in the Omaha housing market do not indicate a collapse. Instead, we are seeing a softening from extreme seller-favored conditions toward a healthier balanced market. Key reasons it is not a crash:

- Sales are up year over year. That indicates active demand, not a market freeze.

- Inventory increases are returning the market toward normal pre-pandemic levels instead of signaling a sudden oversupply collapse.

- Median prices are largely flat rather than collapsing. New construction and existing homes are showing different behaviors, but neither shows free-fall declines.

- Employment remains healthy locally which supports buyer capacity.

Neighborhood and price point nuance

Always remember real estate is local. The Omaha housing market is not a single homogenous place. Midtown, West Omaha, Douglas County, and Sarpy County can all behave differently. Neighborhoods, school districts, and price tiers will show variation. A well marketed mid-priced home near good schools can still move quickly, while higher priced or niche properties may take longer.

Data highlights at a glance

- Total active listings: 2,415 (up 15.4 percent year over year)

- New construction active listings: 946 (down 4.6 percent year over year)

- Existing home listings: 1,469 (up 33.5 percent year over year)

- Median sale price (Douglas and Sarpy County): $321,000 (down 1.2 percent year over year)

- New construction median price: approximately $430,575 (up about 3.2 percent year over year)

- Existing home pricing: largely flat year over year

- Closed sales in September: 938 (up 13.8 percent year over year)

- 30-year mortgage rate: about 6.17 percent

- Existing market months of inventory: 1.9 months

- Median days on market for existing homes: 8 days

- Inflation (August): 2.9 percent

- Lumber price per 1,000 board feet: $597

- Unemployment: national 4.6 percent; Douglas County about 3.12 percent; Sarpy County about 2.8 percent

FAQs about Omaha housing market

Is the Omaha housing market crashing?

No. The market is not crashing. What we are seeing is a return toward a more normal balance between buyers and sellers. Sales are up, inventory has increased from pandemic lows, and median prices are largely flat rather than collapsing. Local variation still exists, so some neighborhoods may soften more than others.

What does rising inventory mean for buyers?

Rising inventory gives buyers more choices and more negotiating power. Expect inspections, repair requests, and occasional seller concessions to be back in play. However, desirable homes priced well will still move quickly, so buyers should be ready to act.

Should I wait for mortgage rates to fall before buying in Omaha?

Trying to time rates is risky. If you can afford a home today and plan to stay for at least five years, buying now is a reasonable strategy. Mortgage rates are lower than earlier in the year but unlikely to return to the extremely low levels of the early 2020s. Keep in mind that if rates fall later you can refinance, but that should be viewed as a potential bonus not a guarantee.

Are prices dropping in every neighborhood?

No. Pricing is not uniform across the Omaha housing market. Some neighborhoods and price points will soften more than others. High-demand pockets can still command quick sales and near-asking price results, while slower segments will see longer days on market and more negotiation.

What are the best opportunities this fall?

Fall can be a good time to find deals. Sellers and builders who want to close before year end may offer incentives. Builders sometimes increase prices at the start of a new year, so buying in the fall can lock in a current price. Also, some sellers get discouraged if activity slows over the holidays, creating windows for buyers to negotiate stronger terms.

How much should I reduce my price if my home is not getting activity?

If you need to reduce price to generate interest, make the adjustment significant enough to reenter a different buyer search pool. Small reductions of a few thousand dollars rarely change buyer perception. For many price points, a reduction large enough to shift the listing into a new search bracket or to match comps will create attention and show meaningful movement to buyers and agents.

Is there anything buyers should bring with them to a builder model?

Yes. Bring your real estate agent on the first model visit. Most builders require that your agent is present for that initial meeting to protect buyer representation. Also come prepared with a list of questions about price, allowances, timelines, and included finishes. Know how incentives are structured and whether they are negotiable.

Bottom line

The Omaha housing market is normalizing. The shift gives buyers more room to negotiate and more inventory to choose from, while sellers who price correctly can still achieve strong results. This is not a crash. It is a transition away from pandemic extremes toward a healthier, more balanced market.

If you are actively buying or selling, the most important steps are simple and practical: understand your budget, get preapproved, price thoughtfully, and work with a local expert who knows neighborhood differences. The Omaha housing market has always been local in its behavior. Pay attention to the local facts, not the headlines, and you will make a smarter decision for your situation.

Have questions, curious about the market, or not sure where to start with the home buying or selling process? Reach out anytime — call or text: 402-490-6771. I’m happy to help you understand your options and next steps.

DAVID MATNEY

David Matney is a trusted Realtor® and local expert with over 20 years of experience in Omaha’s real estate market.