Omaha Housing Inventory Just Hit a 10-Year HIGH (What It Means for Buyers and Sellers)

The latest numbers for Omaha housing are sending a clear message: inventory is up, buyers have more choices, and sellers need to adapt to a more normal market. After nearly a decade of historically tight supply, Douglas and Sarpy County are seeing conditions that look familiar—more homes on the market, longer negotiation windows, and moderated price growth. This is not a crash. It is a reset. If you care about Omaha housing—whether you are buying, selling, or planning a move—understanding the data right now will help you make smarter decisions.

Table of Contents

- Omaha Market Snapshot

- Why Omaha Inventory Is Rising and What It Means

- New Construction Versus Existing Homes in Omaha

- Omaha Home Prices: Slowing Growth, Not Collapse

- Interest Rates and Mortgage Considerations

- Economic Signals to Watch for Omaha Housing

- Demographics and First-Time Buyers

- Practical Guidance for Buyers and Sellers in Omaha Housing

- What to Expect in Omaha Real Estate

- FAQs About Omaha Real Estate Market

- Final thoughts

Omaha Market Snapshot

Here are the core figures shaping Omaha housing right now:

- Active listings: 2,522 homes active in Douglas and Sarpy County, up about 15.3% compared to last year.

- New construction inventory: 983 homes listed (down roughly 2.9% year over year, though many of these listings are at the lot or pre-construction stage).

- Existing home inventory: 1,538 active listings, an increase of approximately 31% versus last year.

- Closed sales last month: 1,003 transactions, up about 17.6% year over year.

- Median sale price (October):$327,000, which is up about 2.2% from 2024.

- Median days on market (existing): 8 days.

- Months of supply (existing): 2 months.

Two points jump out. First, this is the most inventory the market has seen since October 2015. Second, despite the inventory increase, the market still shows seller-leaning indicators: low median days on market and roughly two months of supply for existing homes. Those two facts together describe a transition state: inventory is rising and buyers have more leverage, but demand remains strong enough to keep turnover brisk.

Why Omaha Inventory Is Rising and What It Means

Inventory rarely moves in isolation. A mix of life events, builder decisions, and lending dynamics drives what we see on the MLS. In Omaha housing, sellers who built equity during the last decade are choosing to sell for predictable reasons: job changes, family changes, downsizing or upsizing, and personal circumstances often summarized as the four Ds: diamonds, diapers, divorce, and death.

When inventory increases, buyers get pickier. Home inspections are back in play as a bargaining tool. Buyers are asking for repairs and concessions, and fewer transactions are finishing at full list price. For sellers, the result is straightforward: present your home in its best light and price it realistically.

Seller checklist for a normal Omaha housing market

- Service HVAC: clean and service furnace and air conditioning before listing.

- Complete deferred maintenance: take care of honeydew items that have been put off.

- Deep clean and stage: professional cleaning and staging help your home stand out when buyers have more choices.

- Price for local competition: realistic pricing wins more attention and reduces time on market.

New Construction Versus Existing Homes in Omaha

New construction listings are present but the headline number can be misleading. Of the 983 new-construction entries on the MLS, many are contracts, lots, or homes at the framing stage rather than move-in ready units. Builders often list contract homes on the MLS after a buyer signs, which inflates the active listing number compared to true completed inventory.

By contrast, existing homes are showing a sharper increase in active listings, up roughly 31% year over year. That suggests more homeowners are making the move for personal reasons rather than supply being driven solely by new construction.

Sales mix and seasonality

Closed sales last month were about 1,003 total, with 151 closed in the new construction category and 852 in the existing market. The new construction market tends to be steady through the year while existing home sales follow the familiar seasonal pattern: a summer peak, a fall decrease, a winter trough, and a spring uptick.

Omaha Home Prices: Slowing Growth, Not Collapse

Omaha housing price growth is moderating—intentionally and necessarily. The median sale price in October was $327,000, up 2.2% year over year. That’s a far cry from the 14.9% jump seen from October 2021 to October 2022, which was unsustainable. Slower price growth is healthy. It helps keep affordability from eroding too quickly and discourages speculative excess.

New construction and existing homes are both showing modest appreciation. The median sale price for new construction sits notably higher than existing homes, reflecting newer features, warranties, and often larger footprints. Expect new construction to remain priced at a premium, while existing homes offer more variety across price points.

Price per square foot

Looking at a 12-month rolling average, the median price per square foot for new construction is about $258 while existing homes average around $216 per square foot. That gap underscores the value assigned to new finishes, modern layouts, and builder guarantees in Omaha housing.

Days on market and months of supply explained

The median days on market for existing homes is currently 8 days, meaning half of the sold homes closed in less than eight days on the market and half took longer. Two months of supply indicates that, at the current sales pace, the active inventory would be exhausted in roughly two months if no new listings came online.

Less than two months of supply is typically considered a seller's market, and yet buyers today have more negotiation power than they did during the hottest periods of the last decade. That combination creates a subtle balance: sellers still benefit when their property is priced and presented well, but buyers can ask for repairs and concessions in many situations.

Interest Rates and Mortgage Considerations

Mortgage markets matter for Omaha housing because they determine monthly payments and buyer affordability. The 30-year fixed rate is floating around the low 6 percent range—about 6.32% recently reported. Rates move based on the bond market and broader Fed expectations, not solely on the Fed funds rate. For example, a recent Fed funds rate reduction did not necessarily translate into immediate lower mortgage rates because the bond market adjusted to new forward guidance.

There is never a perfect time to buy. If you can afford the monthly payment, have reserves, plan to stay at least five years, and buy a quality home in a stable neighborhood, the risk profile is reasonable. Home ownership always involves some level of risk. Inspections and due diligence reduce risk, but never eliminate it.

What about a 50-year mortgage?

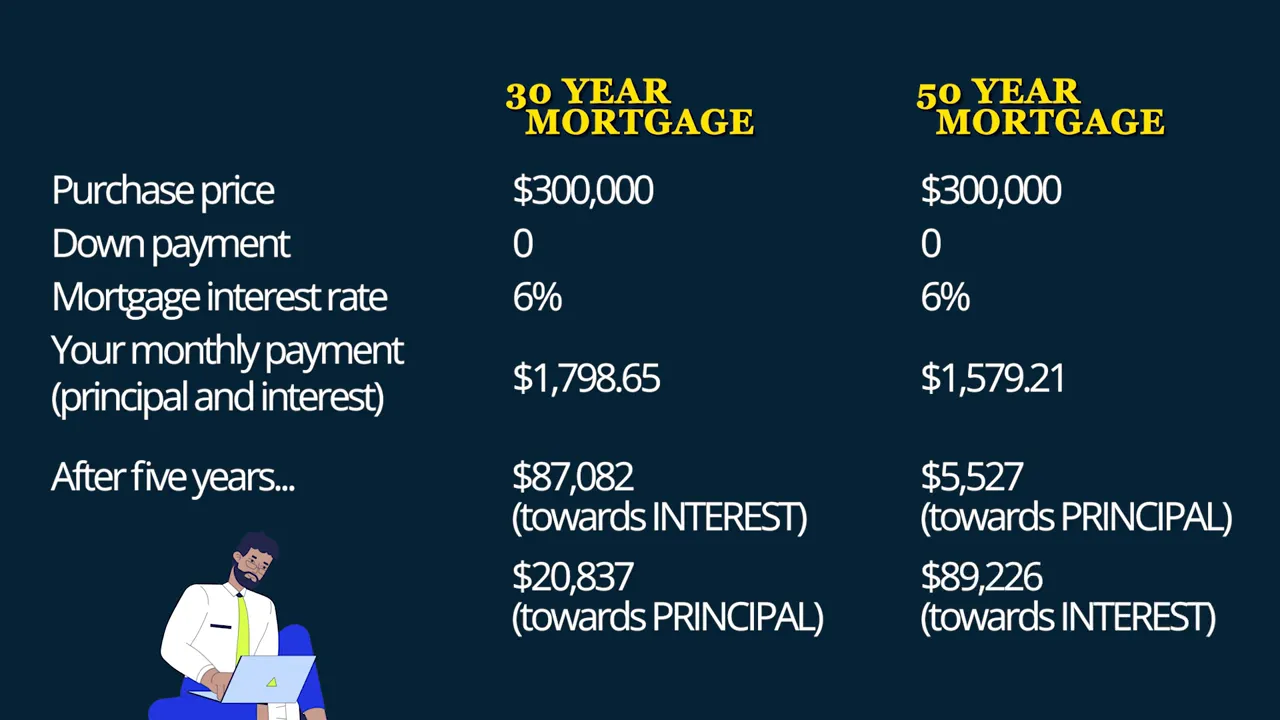

There has been discussion about extending mortgage terms to 50 years to lower monthly payments. That might sound appealing, but it comes with trade-offs. If you compare a 30-year mortgage to a 50-year mortgage on a $300,000 purchase at 6% interest with no down payment, the numbers tell the story:

- 30-year principal and interest payment: approximately $1,799 per month. After five years, about $87,882 has gone to interest and $20,837 to principal.

- 50-year principal and interest payment: approximately $1,579 per month. After five years, about $89,226 has gone to interest and only $5,527 to principal.

A 50-year mortgage reduces immediate payments but delays equity-building and leaves you paying more interest over time. For many buyers, that means assuming the responsibilities and risks of home ownership while gaining very little principal reduction early on.

Economic Signals to Watch for Omaha Housing

Several macro indicators affect local housing markets. Right now, watch these items closely:

- Unemployment data: Government shutdowns or reporting delays can temporarily blindside economic readings and affect Fed policy decisions. If unemployment drifts higher, demand for housing could soften.

- Inflation readings: Delayed inflation data can shift rate expectations. The Fed uses inflation and unemployment to set policy, and uncertainty there affects rates and buyer confidence.

- Lumber and construction costs: Lumber recently fell to about $530 per thousand board feet, signaling some softening in material demand. If builders see weaker pricing and slowing sales, they will dial back new starts.

- Builder behavior: Builders have a vote. If margins compress or demand drops, builders will reduce construction, which eventually removes supply and supports prices.

Those moving pieces mean that, even if sales volumes slow temporarily, an outright price collapse is not the default outcome. Builders will adjust output, and pent-up demand remains, particularly from older buyers and those who lost purchasing power in recent years.

Demographics and First-Time Buyers

One of the striking national trends affecting Omaha housing is the decline in first-time buyers. According to NAR, first-time buyers represent roughly 21 percent of the market this year—an all-time low compared to the 35 to 40 percent range seen 15 years ago. The median age of first-time buyers in the U.S. is around 40.

That matters because a lower share of first-time buyers reduces churn at the entry-level, affecting competition and price dynamics for starter homes. As younger buyers delay purchases, the market skews more toward move-up and resale transactions until affordability improves.

Practical Guidance for Buyers and Sellers in Omaha Housing

For sellers

- Focus on presentation and repairs. With more inventory, homes that require fewer buyer concessions get better results.

- Leverage equity. Many sellers have built significant equity and can comfortably upgrade or move.

- Price competitively. Overpricing reduces showings and can lead to price drops later in negotiations.

For buyers

- Do your homework. Inspections and negotiation are back in play; use them.

- Have financing lined up. Preapproval and a clear budget are critical when opportunities arise quickly.

- Think long term. If you plan to stay at least five years, your position is stronger because you have time to ride out short-term rate or price changes.

What to Expect in Omaha Real Estate

Expect Omaha housing to continue its transition toward a more balanced market. Prices are likely to show modest gains or flatten out with anemic growth rather than rapid appreciation. Builders will watch profit margins closely and will cut back if sales soften significantly. That move will reduce future supply and ultimately help stabilize prices.

In short, this is not a market crash. It is an adjustment after an extraordinary run. Buyers gain negotiating power and more choices. Sellers can still succeed, but they must prepare and price for the current environment.

FAQs About Omaha Real Estate Market

Is Omaha housing in a buyers market or a sellers market right now?

Technically, the existing market indicates a seller's market by traditional metrics—two months of supply and a median days on market of eight days. However, rising inventory has given buyers more negotiating power, so the market feels more balanced than it did during the peak seller environment.

How much has inventory increased for Omaha housing?

Active listings across Douglas and Sarpy County are up approximately 15.3% overall compared to last year, with existing home listings up around 31%.

Are home prices falling?

No. Prices are moderating. The median sale price in October was about $327,000, up roughly 2.2% year over year, which signals slowed growth rather than a price collapse.

Should sellers make repairs before listing?

Yes. With more homes to compete against, performing routine maintenance, servicing mechanical systems, deep cleaning, and staging often leads to faster sales and fewer buyer requests for concessions.

Is a 50-year mortgage a good idea?

A 50-year mortgage lowers monthly payments but greatly slows principal repayment. After five years, you will have paid far more in interest and accumulated very little equity compared to a 30-year mortgage. It may help short-term affordability but carries long-term costs.

What should buyers focus on in the current Omaha housing market?

Buyers should secure financing, prioritize inspections, focus on properties with strong fundamentals (location, schools, condition), and plan to hold for at least five years to reduce timing risk.

Final thoughts

Omaha housing is in a healthier, more sustainable phase. The days of hyper-competition are receding. That does not mean opportunities vanish—far from it. Buyers can breathe a bit easier and negotiate. Sellers who prepare and price correctly will still find eager buyers. Watch the data—inventory, sales, price per square foot, and mortgage rates—and make decisions based on your timeline and risk tolerance. Markets change, and the smart move is to adapt.

For anyone thinking about making a move, remember: a home is part shelter, part investment, and part lifestyle. Focus on the long-term picture, and use the current Omaha housing conditions to your advantage.

Ready to talk about Omaha housing?

If you’re thinking about buying, selling, or just want personalized market advice, I can help. Call or text me, David Matney at 402-490-6771.

DAVID MATNEY

David Matney is a trusted Realtor® and local expert with over 20 years of experience in Omaha’s real estate market.